Loading

Get Verification Of Mortgage Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Mortgage Form online

Completing the Verification Of Mortgage Form online can streamline your mortgage process and ensure you have all the necessary information readily available. This guide provides clear and concise instructions to help you navigate through each section of the form effectively.

Follow the steps to complete your Verification Of Mortgage Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the borrower(s) information by entering the names in the designated fields. This section is critical as it identifies who is applying for the mortgage.

- Enter the loan number in the provided field. This number is unique to your mortgage application and helps the lender track your application.

- Complete the property address section by filling in the street address, city, state, and ZIP code of the property associated with the mortgage.

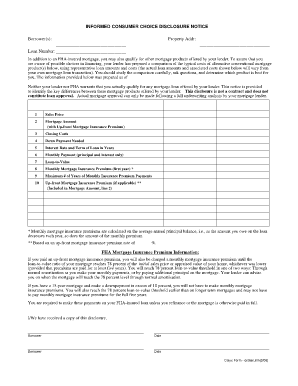

- Review the comparison of mortgage products provided in the form. Make sure to comprehend the options, including sales price, mortgage amount, closing costs, down payment needed, interest rate, and loan terms.

- Analyze the monthly payment details, including principal and interest, as well as the mortgage insurance premiums. This information plays a key role in understanding the long-term financial commitment.

- Confirm that you understand the details outlined in the FHA mortgage insurance premium information section. Make sure to ask your lender if any parts are unclear.

- In the signature fields, each borrower must sign and date the form to acknowledge receipt of the disclosure. Ensure that dates are formatted appropriately.

- Once all fields are completed accurately, you can save the changes, download, print, or share the form as necessary.

Start your document preparation by filling out the Verification Of Mortgage Form online today.

Loan processors and underwriters use a variety of documents to verify your income. These include bank statements, paycheck stubs, W-2 forms and tax returns. Collectively, these documents show the mortgage lender how much money you earn today, and how much you've earned over the past couple of years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.