Loading

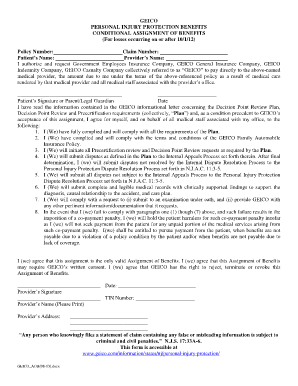

Get Emergency Lieap Fy 2013. Instructions For Form 945, Annual Return Of Withheld Federal Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Emergency LIEAP FY 2013. Instructions For Form 945, Annual Return Of Withheld Federal Income Tax online

This guide provides clear and supportive instructions on how to complete the Emergency LIEAP FY 2013. Instructions For Form 945, Annual Return Of Withheld Federal Income Tax online. Follow each step carefully to ensure accurate submission of your form.

Follow the steps to complete your form successfully.

- Click 'Get Form' button to acquire the document and open it for editing.

- Begin by filling in the general identification information at the top of the form, including your name, address, and contact details.

- Proceed to the section concerning withheld federal income tax. Enter the amounts withheld during the fiscal year accurately.

- Complete the relevant sections regarding adjustments and credits you may be entitled to claim.

- Review all filled details to ensure that there are no errors or omissions.

- Once you have verified the information, you can save your changes. You may also choose to download, print, or share the completed form as needed.

Take the next step by completing your Emergency LIEAP FY 2013. Instructions For Form 945 online today.

A withholding allowance is to be worth $4,200 in 2019, up from $4,150 in 2018, the Early Release Copies of the 2019 Percentage Method Tables for Income Tax Withholding showed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.