Loading

Get Homeowners Exemption Application - Nyc.gov - Nyc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Homeowners Exemption Application - NYC.gov - Nyc online

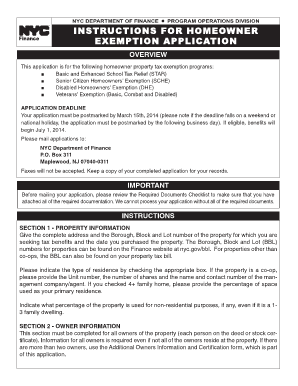

The Homeowners Exemption Application enables eligible homeowners in New York City to apply for various tax exemption benefits. This guide provides step-by-step instructions to assist users in filling out the application effectively and efficiently.

Follow the steps to complete your application.

- Press the ‘Get Form’ button to obtain the application form and access it in the online editor.

- In Section 1, provide the complete address of the property, including the Borough, Block, and Lot number. Indicate the date of purchase and select the type of residence by checking the corresponding box.

- Complete Section 2 by providing the name, date of birth, and Social Security number for all owners. If applicable, indicate if this is each owner's primary residence and their relationship to one another.

- In Section 3, answer questions regarding any other properties owned and their exemption status. Provide additional property information if necessary.

- Fill out Section 4 by supplying proof of income for all owners. Attach copies of tax returns or other income documentation as required.

- In Section 5, provide occupancy information, confirming that all owners occupy the property as their primary residence or indicating any exceptions.

- If applicable, complete Section 6 for Senior Citizen Homeowners and Section 7 for Disabled Homeowners by providing required documentation such as government-issued ID or proof of disability.

- In Section 8, indicate if any owners are veterans and provide the necessary documentation.

- Finally, all owners must sign and date the application in Section 9 and provide contact information for any follow-up questions.

- Once completed, save your changes, download the form, print it out, and mail it with all required documentation to the NYC Department of Finance.

Complete your Homeowners Exemption Application online today to secure your tax benefits.

Related links form

For senior citizens (aged 60 years or above but less than 80 years), income up to Rs 3 lakh is exempt from tax. Income from Rs 300,001 to Rs 5 lakh is taxed at 5 per cent, from Rs 500,001 to Rs 10 lakh at 20 per cent and above Rs 10 lakh at 30 per cent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.