Loading

Get Mw506fr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw506fr online

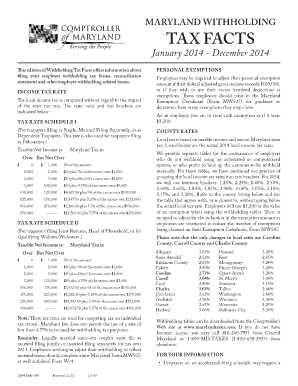

Filling out the Mw506fr form online is a crucial process for employers to report withholding taxes correctly. This guide provides clear and concise instructions to help you navigate each section of the form effortlessly.

Follow the steps to complete the Mw506fr online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer information in the designated fields, including your business name, address, and employer identification number (EIN). Ensure that all details are accurate to avoid any issues during processing.

- Proceed to fill out the income details. Input the total amount withheld in the prescribed section. Be meticulous with your calculations to ensure compliance with the tax rates applicable to your income.

- Review the county tax rates applicable to your business location. Ensure that you apply the correct local tax rate to calculate the total withholding accurately.

- Check the section that requires you to confirm any adjustments, exemptions, or additional credits being applied. This may include referencing any personal exemptions claimed on Form MW507.

- Once all required sections are completed, review your entries for accuracy. This step is essential to prevent errors that may lead to penalties or delays.

- After confirming that all information is correct, save your changes. You can then choose to download, print, or share the completed form as required.

Complete your withholding tax documents online today for a seamless filing experience!

You can obtain the registration form and more information by calling Taxpayer Service at 410-260-7980, or 1-800-MD TAXES.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.