Loading

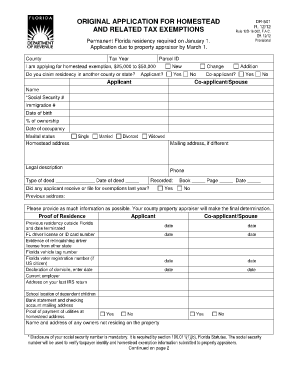

Get Original Application For Homestead

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ORIGINAL APPLICATION FOR HOMESTEAD online

Filling out the original application for homestead can seem daunting, but with clear guidance, you can complete it effectively online. This guide provides step-by-step instructions tailored to assist you in navigating each section of the application.

Follow the steps to complete your application seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by filling out your personal information. Include the applicant’s name, social security number, immigration number, date of birth, and percentage of property ownership. Make sure to enter the homestead address accurately.

- Indicate your marital status by selecting from the provided options, and include any co-applicant or spouse details if applicable. Enter their information, including their name and social security number.

- Provide the legal description of the property and select the type of deed. Ensure the phone number and date of deed are entered correctly.

- Answer whether you or the co-applicant received or filed for exemptions in the previous year. If applicable, detail your previous address.

- Gather and provide proof of residence documents. Include any additional residency evidence requested in the form, such as Florida driver license number, voter registration number, and utility payments at the homestead address.

- Fill out any additional benefits you may be applying for, such as exemptions for age, disability, or veteran status. Specify and provide necessary documentation.

- Complete the declaration section. Affirm your eligibility for the exemptions and understand the penalties for providing false information.

- Finally, ensure all sections are complete, and review your entries for accuracy. Save changes, download, print, or share your filled application as needed.

Start your application online to take the first step towards securing your homestead exemption.

What Homestead Exemption Means. Under the provisions of the Homestead Amendment, a person or persons must be 65 years of age or older or totally disabled during the year for which application is made, and must own and occupy a residential unit as of January 1 for that year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.