Loading

Get Borrowers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borrowers Form online

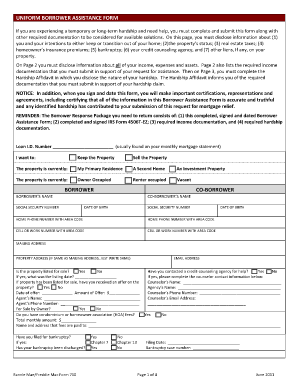

Completing the Borrowers Form online is a critical step for individuals facing hardship and seeking mortgage assistance. This guide provides clear instructions to help you navigate each section and ensure that all necessary information is accurately submitted.

Follow the steps to complete the Borrowers Form effectively.

- Press the ‘Get Form’ button to access the Borrowers Form, bringing it into your preferred viewing platform for completion.

- Begin by providing details about yourself and your goals regarding the property. Indicate whether you wish to keep or sell the property and its current status as your primary residence or otherwise.

- Enter your personal information, including your name, social security number, and contact numbers. Be sure to add details for your co-borrower, if applicable.

- Disclose your property's status, including whether it is owner-occupied or rented. If applicable, note any homeowner association fees you may have.

- Provide information regarding any previous contact with a credit counseling agency and the status of the property in terms of sales or offers received.

- On the second page, detail your household's income, expenses, and assets. Ensure you include all relevant sources of income and any outstanding debts.

- Document your hardship in the Hardship Affidavit section, specifying the nature of your financial challenges and how long they have been affecting you.

- Review the required documentation necessary to support your hardship claim and ensure that you have completed and collected all necessary papers.

- Finish by signing and dating the form. This step confirms that all information provided is accurate and truthful.

- After completing the form, you can save changes, print a copy for your records, download it, or share it as needed.

Complete your Borrowers Form online today to take the first step towards securing mortgage relief.

Related links form

Step 1: Access your PPP Application. ... Step 2: Add or Confirm Existing Business Information. ... Step 3: Add New Requirements for Business Information. ... Step 4: Enter or Confirm Ownership. ... Step 5: Enter or Confirm Additional Owner Info. ... Step 6: Upload or Confirm Documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.