Loading

Get Sc1120s Wh Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC1120S WH Instructions online

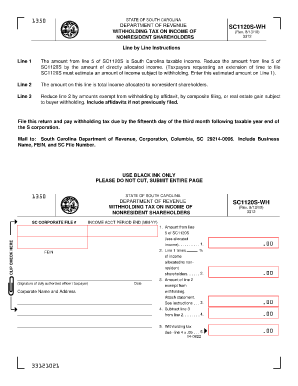

Filling out the SC1120S WH Instructions is essential for managing withholding tax on income generated by nonresident shareholders. This guide provides a step-by-step approach to ensure you accurately complete the form online, facilitating compliance with South Carolina tax regulations.

Follow the steps to effectively fill out the SC1120S WH Instructions online.

- Click ‘Get Form’ button to obtain the SC1120S WH Instructions and open it in your preferred online editor.

- Begin by entering the amount from line 5 of the SC1120S on line 1 of the form. Remember to reduce this amount by directly allocated income, ensuring the correct taxable income is reflected.

- On line 2, input the total income that is allocated specifically to nonresident shareholders. This amount is crucial for subsequent calculations.

- For line 3, reduce the amount entered on line 2 by any amounts that are exempt from withholding. This includes exemptions from affidavits and real estate gains subject to buyer withholding. Ensure to attach any relevant affidavits if they have not been submitted previously.

- Subtract the figure from line 3 from the total on line 2 and enter the result on line 4. This will determine the taxable income on which you will calculate withholding tax.

- Calculate the withholding tax due by multiplying the amount on line 4 by the appropriate rate (0.05). Enter this result on line 5 of the form.

- Once all information is correctly filled in, review the form for accuracy. After confirming all details, you can save changes, download a copy for your records, print it, or share it as needed.

Start completing the SC1120S WH Instructions online today to ensure timely submission and compliance.

Related links form

South Carolina DOR Releases Form SC1120S-WH, Withholding Tax on Income of Nonresident Shareholders With Instructions. The South Carolina Department of Revenue (DOR) July 12, 2021 released Form SC1120S-WH, Withholding Tax on Income of Nonresident Shareholders, for individual income tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.