Loading

Get Schedule C Kdor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule C Kdor Form online

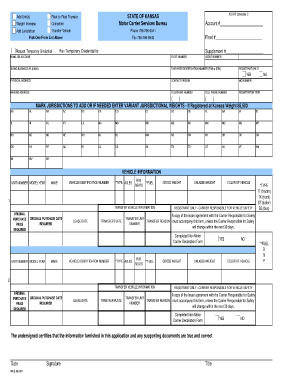

Filling out the Schedule C Kdor Form online can seem daunting, but with this comprehensive guide, you will navigate through each section with ease. This form is essential for managing vehicle-related applications, ensuring a smooth process for your fleet.

Follow the steps to complete the Schedule C Kdor Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section A, where you will fill out details for each vehicle. You will need to input the US DOT number and specify whether you are adding or transferring a vehicle. Check the applicable boxes for each action.

- If you are adding a vehicle, provide the necessary information such as the type (Truck Tractor, Straight Truck, Semi Trailer, Utility Trailer, or Bus), vehicle color, axles, and seats if applicable.

- For transferring a vehicle, fill out Section A, followed by Section B, which includes details like the transfer reason, the Vehicle ID number (VIN), and the apportioned plate number.

- In Section B, ensure you complete all relevant fields regarding the vehicle you are transferring or replacing, including specifics about the new and old equipment numbers.

- Proceed to Section C, where you will input details about the fuel type, unladen weight, registered gross weight, garage address, purchase date, and any relevant identification numbers.

- Once all sections are completed and reviewed, you can save your changes, download a copy of the form, print it out, or share it as required.

Complete your Schedule C Kdor Form online today for an efficient process.

Step 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. ... Step 2: Calculate Gross Profit and Income. ... Step 3: Include Your Business Expenses. ... Step 4: Include Other Expenses and Information. ... Step 5: Calculate Your Net Income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.