Loading

Get Becu Third Party Transfer Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Becu Third Party Transfer Authorization online

Filling out the Becu Third Party Transfer Authorization is essential for managing your accounts efficiently. This guide provides you with clear instructions to ensure you complete the form accurately, facilitating smooth processing of your request.

Follow the steps to accurately complete the authorization form.

- Press the ‘Get Form’ button to obtain the Becu Third Party Transfer Authorization form and open it in an online editor for completion.

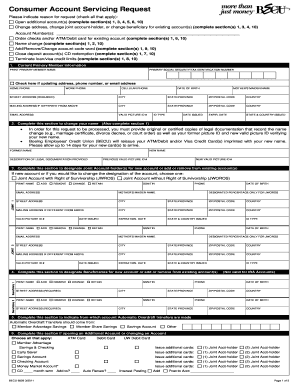

- Indicate your reason for the request. Check all applicable options, such as opening additional accounts, changing an account-holder, or closing an account. Make sure to complete the relevant sections specified for your requests.

- In Section 1, provide your current primary member information. Fill out all required fields, including your name, Social Security Number or Tax Identification Number, and contact information. Ensure your address is current and accurate.

- If you are changing your name, complete Section 2. Include your former name and new name, along with a description of the legal documentation provided to support this change.

- In Section 3, designate joint account-holders if applicable. Fill in their details accurately, including their name and verification information, as well as the type of rights associated with the account.

- Complete Section 4 if you need to designate beneficiaries for your accounts. Provide the necessary identifying information for each beneficiary.

- In Section 5, specify the source account for automatic overdraft transfers if you wish to set this up.

- If you are opening an additional account or making changes, complete Section 6 with your preferences for new cards or account types, ensuring all information is clear and complete.

- If you are closing an account, fill out Section 7, marking all accounts you wish to close and providing the necessary details about balance dispositions.

- Complete Section 10 by signing and dating the form. Ensure all signatories have provided their signatures where indicated, confirming the accuracy of the information provided.

- Once you have verified that all information is complete and accurate, proceed to save your changes, download the form, and print it for your records or sharing.

Start completing your Becu Third Party Transfer Authorization online today.

Related links form

Deposit cash at the bank. The most basic way to move money into someone else's account is to walk into the bank and tell the teller you'd like to deposit cash. ... Transfer money electronically. ... Write a check. ... Send a money order. ... Send a cashier's check. ... Make a wire transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.