Loading

Get Health Savings Account Distribution Form Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account Distribution Form Fillable Form online

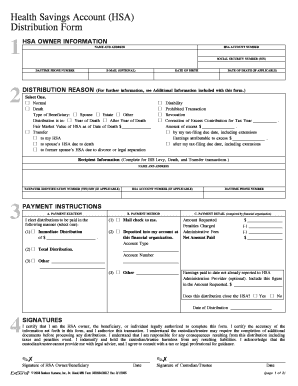

The Health Savings Account Distribution Form Fillable Form is a vital document for users managing their health savings accounts. This guide provides comprehensive, step-by-step instructions to ensure each section is filled out accurately and efficiently.

Follow the steps to complete the Health Savings Account Distribution Form online.

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin with the HSA owner information. Fill in your name and address, HSA account number, social security number, daytime phone number, and optional email address. This section ensures your identity is verified.

- Next, specify the distribution reason. Select from options such as normal, death, disability, prohibited transaction, revocation, or correction of excess contribution. Each option may have additional fields to complete.

- If the reason is death, provide details regarding the date of death, the type of beneficiary (spouse, estate, or other), and whether the distribution is during or after the year of death.

- For transfers, indicate whether assets are moving to your HSA, a spouse's HSA due to death, or due to divorce or legal separation. Ensure to include the relevant account information and descriptions.

- Complete the recipient information for transactions that involve an IRS levy, death, or transfer. Include the name and address, taxpayer identification number or SSN, and HSA account number for the recipient.

- Fill out payment instructions, including your preferred payment election (immediate distribution or total distribution) and method (mail check or deposit). Specify any additional account details as necessary.

- Review the payment details that are completed by the financial organization. This area captures the amount requested, any penalties charged, administrative fees, and the net amount paid.

- Authorize the form by signing and dating in the designated areas. Ensure that the individual completing the form certifies the accuracy of all provided information and understands the implications of this transaction.

- Finally, after all sections are completed, save your changes. You can download, print, or share the form as needed to finalize your documentation.

Complete your Health Savings Account Distribution Form online today to manage your account effectively.

If you (or your spouse, if filing jointly) received HSA distributions in 2019, you must file Form 8889 with Form 1040, Form 1040-SR, or Form 1040-NR, even if you have no taxable income or any other reason for filing Form 1040, Form 1040-SR, or Form 1040-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.