Loading

Get Form 512

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 512 online

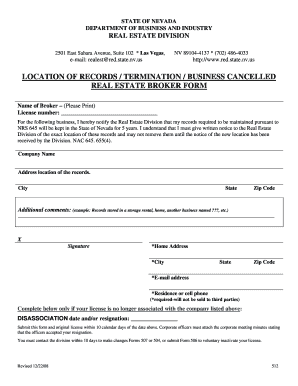

Filling out the Form 512 is an essential process for notifying the Real Estate Division regarding the location of your records. This guide will help you navigate the online form step-by-step, ensuring that you complete it accurately and efficiently.

Follow the steps to complete Form 512 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name as the broker in the designated field, ensuring proper spelling and format.

- Enter your license number in the space provided. Double-check for accuracy.

- Indicate the location where your records will be maintained for 5 years in the next section. Include the company name and full address, including city, state, and zip code.

- Add any additional comments regarding the location of your records if necessary, clarifying any storage details.

- Sign the form electronically in the signature field to affirm the information provided.

- Complete your home address, city, state, zip code, email address, and either residence or cell phone number as required.

- If your license is not associated with the company mentioned, fill in the disassociation date or resignation date in the appropriate space.

- Review all entered information for accuracy before final submission.

- Save your changes, and use the options available to download, print, or share the form as needed.

Complete your Form 512 online today and ensure your records are properly maintained.

The self-employment tax rate is 15.3% of all self-employment income, assuming your income from self-employment exceeds per year in Oklahoma City, Oklahoma. But half of your self-employment tax liability can be deducted from your income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.