Loading

Get Dr841 Filliable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr841 Filliable online

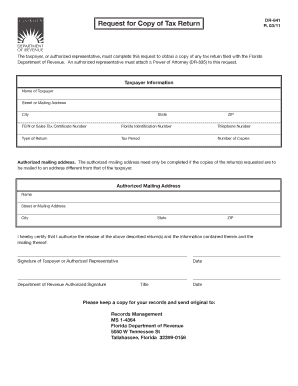

The Dr841 Filliable form is essential for taxpayers seeking to obtain copies of their filed tax returns with the Florida Department of Revenue. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the Dr841 Filliable form quickly and correctly.

- Click ‘Get Form’ button to access the Dr841 Filliable form and open it in your preferred digital editor.

- Begin by filling in the 'Taxpayer Information' section. Provide your full name, street or mailing address, city, state, and ZIP code. This information is crucial for identification purposes.

- Enter your Federal Employer Identification Number (FEIN) or Sales Tax Certificate Number, followed by your Florida Identification Number. These numbers help verify your identity and tax status.

- Input your telephone number to ensure the department can reach you if further information is needed.

- Specify the 'Type of Return' you are requesting copies of, as well as the relevant 'Tax Period'. This information ensures that the correct documents are provided.

- Indicate the 'Number of Copies' you wish to receive. This detail is important for processing your request accurately.

- If the copies should be mailed to an address different from your own, fill out the 'Authorized Mailing Address' section. Include the name, street or mailing address, city, state, and ZIP code.

- Provide your signature or that of the authorized representative in the designated area, confirming your authorization for the release of the requested tax return copies.

- Record the date on which you are signing the form. This is necessary for processing purposes.

- Review all the information you've entered to ensure accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as needed.

Complete your Dr841 Filliable form online today to ensure smooth processing of your tax return copies.

Mortgage lenders may require you to fill out Form 4506-T as part of your mortgage application. It allows them to obtain a transcript of your tax return information directly from the IRS. They use it to verify the other income documentation you provided during the loan application process. Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.