Loading

Get Wisconsin Report Of Business Transfer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Report Of Business Transfer Form online

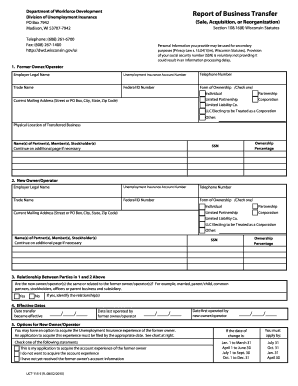

This guide provides clear and supportive instructions on how to complete the Wisconsin Report Of Business Transfer Form online. Whether you are transferring ownership due to a sale, acquisition, or reorganization, this comprehensive overview will assist you through each section of the form.

Follow the steps to complete the form effectively

- Click ‘Get Form’ button to obtain the Wisconsin Report Of Business Transfer Form and open it in your web browser.

- In the first section, 'Former Owner/Operator', fill in the employer legal name, unemployment insurance account number, and telephone number. Also, include the trade name, federal ID number, and select the form of ownership by checking the correct box.

- Enter the current mailing address, including street or PO Box, city, state, and zip code. Then, provide the physical location of the transferred business and the names of any partners, members, or stockholders, along with their ownership percentages and social security numbers.

- Proceed to the 'New Owner/Operator' section. Repeat the process of providing the employer legal name, unemployment insurance account number, telephone number, trade name, federal ID number, and checking the appropriate form of ownership.

- Again, fill out the current mailing address for the new owner/operator and include the names of partners, members, or stockholders along with their respective ownership percentages and social security numbers.

- In the 'Relationship Between Parties' section, indicate whether the new owner/operators are related to the former owner/operators by ticking 'yes' or 'no'. If yes, describe the relationship.

- Fill in the effective dates for the business transfer. Enter the date transfer became effective, the last date the former owner/operator operated, and the first date the new owner/operator began operations.

- Review the options for the new owner/operator regarding the acquisition of the unemployment insurance experience of the former owner. Select the appropriate option based on your decision.

- Complete the 'Method of Transfer' by selecting or specifying the method used to transfer the business, such as sale, merger, or other.

- Provide details on the assets transferred, answering questions on the continuation of business operations, number of employees, and the nature of the business transferred. Specify if it was a total or partial transfer.

- Finally, ensure to include the signatures of authorized representatives for both the former and new owners, indicating their names, positions, and contact details.

- Save your changes, download the completed form, print it for your records, or share it as needed.

Complete your documents online effortlessly and ensure compliance with the necessary reporting requirements.

The Wisconsin Unemployment Insurance program is financed by employers quarterly State and annual Federal Unemployment Tax payments. The Federal Unemployment Tax is used, in part, to finance the administrative expenses of each state's unemployment insurance program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.