Loading

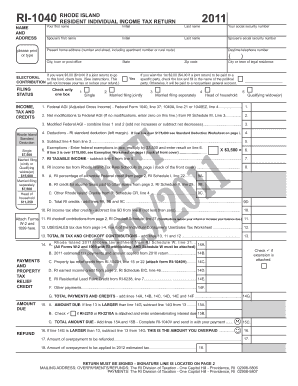

Get 2011 Ri 1040 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Ri 1040 Form online

This guide provides clear and concise instructions for accurately completing the 2011 Ri 1040 Form online. Whether you are a first-time filer or someone with experience, this step-by-step approach ensures that you navigate each section with confidence.

Follow the steps to complete the form effectively.

- Press the 'Get Form' button to access the 2011 Ri 1040 Form and open it in your preferred editing tool.

- Begin by filling in your personal information: enter your first name, middle initial, last name, and social security number. If applicable, include your spouse's details.

- Provide your current home address, including any apartment number or rural route necessary for accurate delivery.

- Select your filing status by checking one of the provided boxes. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report your federal adjusted gross income (AGI) from the relevant line of your federal tax return. Follow this by making any necessary modifications, referenced from the RI Schedule M.

- Calculate your modified federal AGI by combining your original AGI with any net modifications.

- Deduct the Rhode Island standard deduction from your modified federal AGI and enter the result.

- Enter your total exemptions, multiplying your federal exemptions by the set amount for your filing status.

- Determine your Rhode Island taxable income by subtracting your exemptions from your deductions.

- Calculate your RI income tax using the provided Rhode Island Tax Rate Schedule.

- List any allowable credits, such as federal credits or payments made to other states, ensuring to follow the provided instructions and schedules.

- Sum your total payments and credits, including prior year payments and property tax relief credits, to determine your total payments.

- If your total tax amount exceeds your total payments, calculate the amount due. Otherwise, follow the instructions to determine any refund owed to you.

- Ensure all necessary forms and schedules are attached, then sign and date your return.

- Finally, you have the option to save your changes, download the completed form, print it for mailing, or share it as needed.

Complete your 2011 Ri 1040 Form online today to ensure a smooth filing process.

No, Post Offices do not have tax forms available for customers. However, you can view, download, and print specific tax forms and publications at the "Forms, Instructions & Publications" page of the IRS website. ... Your local government offices may have tax forms available for pickup.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.