Loading

Get Registration For Ok Nonresident Contractor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Registration For Ok Nonresident Contractor Form online

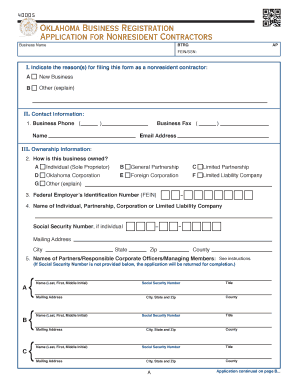

Filling out the Registration For Ok Nonresident Contractor Form online is a crucial step for contractors wishing to operate in Oklahoma. This guide provides you with clear, detailed instructions on how to complete each section of the form efficiently and accurately.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the Registration For Ok Nonresident Contractor Form and open it in your editing interface.

- Complete Page A by entering your business name and Federal Employer Identification Number (FEIN) or Social Security Number (SSN) at the top of the page.

- In Section I of Page A, indicate your reason for filing the form by checking 'A' for new business or 'B' for other. If you select 'B', be prepared to explain your reason.

- Section II requires your contact information. Provide your business phone, fax number, contact name, and email address.

- In Section III, check the box that represents your business ownership type. If you are a sole proprietor, you must complete an affidavit verifying lawful presence in the U.S.

- Input your FEIN in Section III, Item 3. If you do not have one, you need to apply for it, as it is required for processing your registration.

- In Section IV about Withholding Tax, indicate whether you intend to withhold Oklahoma Income Tax from employees. If yes, provide the expected start date and the FEIN used for reporting.

- Section V asks for your physical business location and classification information. Enter all requested details, including physical address, type of contract work, and a trade name (DBA).

- If applicable, enter the amount for cash bond in Section VI. Ensure you understand the bond requirement if your contract exceeds $100,000.

- Finally, date and sign the application in Section VII. Ensure that the signature is from an authorized representative before submission.

- Once completed, review the form for accuracy, save your changes, and submit your registration form online as instructed.

Don't delay, complete your Registration For Ok Nonresident Contractor Form online today to ensure compliance with state regulations.

Single or married filing separately: $6,350. Head of household: $9,350. Married filing jointly or Qualifying widower: $12,700.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.