Loading

Get Form 58 Schedule Kp Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 58 Schedule Kp Instructions online

Filling out the Form 58 Schedule Kp is essential for all partnerships in North Dakota. This guide provides clear, step-by-step instructions to ensure a smooth and accurate completion of the form online.

Follow the steps to successfully complete your Form 58 Schedule Kp online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the name of your partnership in the designated field. Ensure accuracy as this will be used for identification.

- Input the FEIN (Federal Employer Identification Number) for the partnership in the specified section.

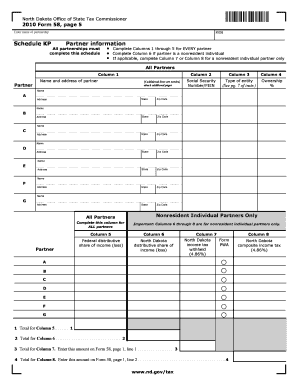

- Complete Column 1 through Column 5 for every partner in the partnership, including their name, address, Social Security number or FEIN, type of entity, and ownership percentage.

- If you have nonresident individual partners, complete Column 6 by entering their federal distributive share of income or loss.

- Proceed to Column 7 and enter the North Dakota Form income tax withheld (4.86%) for each nonresident individual partner.

- If required, complete Column 8 with the North Dakota composite income tax (4.86%) for any nonresident individual partners.

- Review the totals for Column 5, Column 6, Column 7, and Column 8 to ensure that all entries are accurate and add up correctly.

- Once you have completed all sections, you can save your changes, download, print, or share the form as necessary.

Get started on completing your Form 58 Schedule Kp online today!

North Dakota (ND) State Payroll Taxes in 2023 Fortunately, ND has one of the lowest state income taxes in the country. The tax rates range from 1.1% to 2.9%. Only employees who earn more than $433,200 per year will hit the highest tax bracket.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.