Loading

Get W 9 Form Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form Nd online

Filling out the W 9 Form Nd accurately is essential for anyone seeking to provide their taxpayer information to a payor. This guide provides a clear, step-by-step approach to completing the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the W 9 Form Nd online.

- Press the ‘Get Form’ button to retrieve the W 9 Form Nd and access it in the editor.

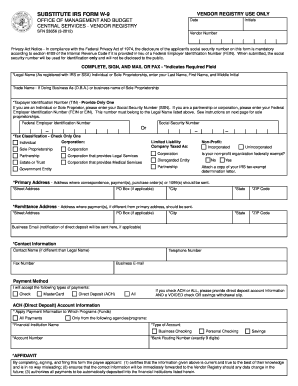

- Enter the legal name as registered with the IRS or Social Security Administration (SSA). For individuals or sole proprietorships, this includes your last name, first name, and middle initial.

- If you operate under a different business name (D.B.A.), provide the trade name in the designated field.

- Input your Taxpayer Identification Number (TIN). If you are an individual or sole proprietor, provide your Social Security Number (SSN). Partnerships and corporations should enter their Federal Employer Identification Number (FEIN or EIN).

- Check the appropriate tax classification by selecting only one option that applies to your legal designation.

- Fill in your primary address where correspondence, payments, or 1099 forms will be delivered.

- If your remittance address differs from the primary address, provide that information in the respective fields. If you prefer email notifications for direct deposits, include your business email in the appropriate section.

- Specify the payment methods you will accept, such as check or electronic options like direct deposit. Complete any necessary ACH account information if electing electronic payments.

- Review the affidavit section carefully. It confirms the accuracy of the information you provided and your authorization for future transactions.

- Complete the IRS Form W-9 certification section by ensuring you meet all indicated criteria. Cross out item 2 if it does not apply.

- Sign and date the form in the designated areas, including your printed name and title.

- Once completed, save the changes made to the form. You may then download, print, or share the completed W 9 Form Nd as required.

Start completing the W 9 Form Nd online today to ensure all your taxpayer information is accurately captured and submitted.

You may also get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.