Loading

Get Nj Non Resident Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Non Resident Certification online

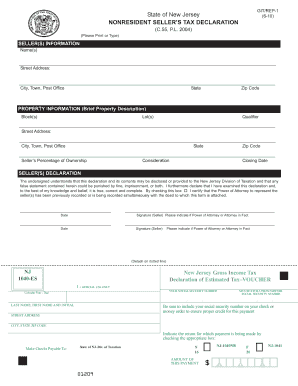

Filling out the Nj Non Resident Certification is an essential step for nonresident individuals selling property in New Jersey. This guide will provide you with a comprehensive overview of the form and detailed instructions on how to complete each section accurately.

Follow the steps to complete the Nj Non Resident Certification online

- Press the ‘Get Form’ button to obtain the Nj Non Resident Certification and open it in the editor.

- Enter the seller's information in the appropriate fields. This includes the name(s) of the seller(s) and their street address, city, state, and zip code. Make sure that the information is accurate and reflects the primary residence or business location of the seller(s).

- Provide the property information, including block and lot numbers, along with a brief property description and the seller's percentage of ownership. Ensure that these details are as stated on the property deed.

- Indicate the total consideration for the property, which includes all forms of payment that constitute the sale. This detail is significant for tax calculation purposes.

- Specify the closing date of the transaction clearly to avoid any issues with recording.

- Both sellers must sign and date the declaration. If a representative is signing, ensure that either a Power of Attorney or a letter granting signing authority is included.

Complete your forms online today to ensure a smooth transaction process.

Related links form

Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return Head of household Qualifying widow(er)/surviving CU partner$20,000 Dec 15, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.