Loading

Get How To Fill Out A Nonprofit Form Np1 Rsa 2922

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out A Nonprofit Form Np1 Rsa 2922 online

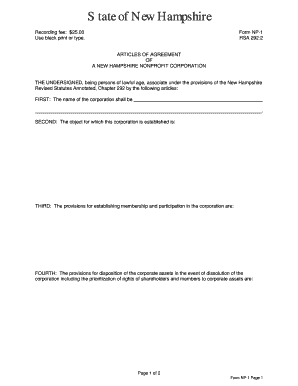

Understanding how to properly fill out the How To Fill Out A Nonprofit Form Np1 Rsa 2922 is essential for establishing a nonprofit corporation in New Hampshire. This guide will provide you with a step-by-step approach to complete the form efficiently and accurately online.

Follow the steps to fill out the nonprofit form online effectively.

- Click the ‘Get Form’ button to retrieve the form and access it in the editor.

- In the first section, provide the name of the corporation in the designated field.

- For the second section, clearly state the purpose or objective for which the corporation is being established.

- In the third section, outline the provisions for membership and participation within the corporation.

- The fourth section requires details on how corporate assets will be managed in case of dissolution, including any prioritization of rights.

- Complete the fifth section by providing the address where the corporation's business will be conducted.

- If applicable, detail the amount of capital stock or number of membership certificates in the sixth section.

- In the seventh section, include any provisions related to limiting the personal liability of directors or officers; if none, state 'NONE'.

- For the eighth section, gather signatures and post office addresses from at least five individuals who are forming the corporation.

- Finally, review all entries for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Start completing your nonprofit form online today!

501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs. Tax-exemption is the result of a nonprofit organization being recognized by the IRS as being organized for any purpose allowable under 501(c)(3) - 501(c)(27).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.