Loading

Get Cit Pv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

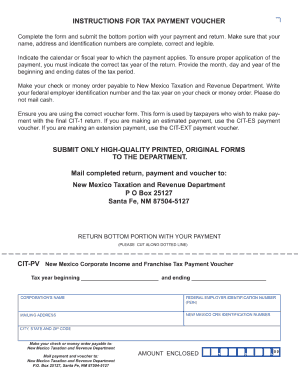

How to fill out the Cit Pv online

Filling out the Cit Pv form online can seem daunting, but this guide will provide you with clear, step-by-step instructions to make the process easier. Whether you have experience with digital documentation or are a novice, this guide is designed to support you in completing the form accurately and efficiently.

Follow the steps to successfully complete the Cit Pv form online.

- Click ‘Get Form’ button to access the form and open it in your editor of choice.

- Begin by reviewing any introductory information provided within the form. This section may outline important instructions or guidelines to assist you in filling out the form correctly.

- Proceed to fill out your personal information. This typically includes your name, contact information, and any other identifying details requested in the designated fields.

- Next, address the specific sections that relate to the purpose of the Cit Pv. This may involve providing additional details or documentation, so ensure you read the prompts carefully.

- Review all information entered to ensure accuracy and completeness. Check each section thoroughly to confirm that no fields are left blank unless specified.

- Upon completing the form, you will have options to save your changes electronically, download a copy to your device, print the document for physical submission, or share it via email or other digital platforms.

Begin the process now by filling out your Cit Pv form online!

Related links form

Michigan has a 6.00 percent corporate income tax rate. Michigan has a 6.00 percent state sales tax rate and does not levy any local sales taxes. Michigan's tax system ranks 12th overall on our 2022 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.