Loading

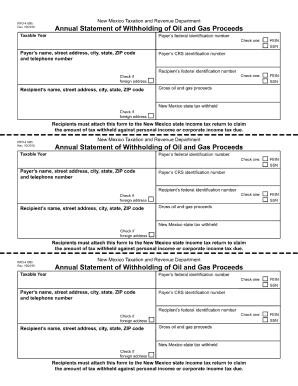

Get Rpd 41285 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rpd 41285 Form online

Filling out the Rpd 41285 Form online can simplify the process and ensure accuracy. This guide will provide you with clear, step-by-step instructions to complete the form effectively, even if you have limited experience with legal documents.

Follow the steps to complete the Rpd 41285 Form online

- Click the ‘Get Form’ button to access the Rpd 41285 Form. This will open the document in the editor, allowing you to view and begin filling it out.

- Carefully read through each section of the form. Familiarize yourself with the required information and specific fields that need to be completed.

- Begin entering your personal information in the designated fields. Ensure that all details are accurate and up to date.

- Proceed to fill out the next sections of the form as indicated. Follow any instructions provided, particularly for complex fields.

- Review the entire form for completeness and accuracy. Make any necessary edits or adjustments to ensure all information is correct.

- Once satisfied with the completed form, you can save your changes to store the document securely.

- Choose to download, print, or share the form as needed to complete the filing process.

Start filling out your Rpd 41285 Form online today for a streamlined experience.

New New Mexico Employer: Register with the New Mexico Department of Workforce Solutions - (877)-664-6984 Register your business with the New Mexico Department of Workforce Solutions. You should receive your Employer Account Number and tax rate instantly after registering.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.