Loading

Get Tax Clearance Certificate Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Clearance Certificate Sample online

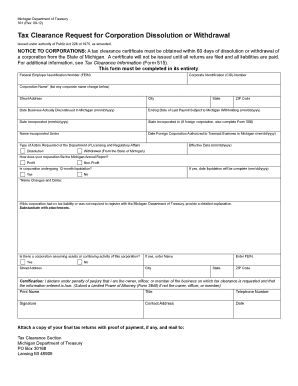

Filling out the Tax Clearance Certificate Sample is an essential step for corporations seeking to dissolve or withdraw from the State of Michigan. This guide provides a clear and supportive overview of how to complete the form correctly online.

Follow the steps to complete the Tax Clearance Certificate Sample online

- Click ‘Get Form’ button to obtain the form and open it in an editable format.

- Enter your Federal Employer Identification Number (FEIN) in the designated field. This number is crucial for identification purposes.

- Provide your Corporate Identification (CID) Number. If you do not have one, check with the Michigan Department of Treasury.

- List your corporation's name in the 'Corporation Name' field and include any corporate name changes underneath.

- Fill in the street address, city, state, and ZIP code of your corporation.

- Indicate the date your business actually discontinued operations in Michigan using the mm/dd/yyyy format.

- State the ending date of your last payroll that was subject to Michigan withholding, again using mm/dd/yyyy format.

- Enter the date your corporation was incorporated, using the specified date format.

- Specify the state where your corporation was incorporated. If it is a foreign corporation, complete the additional required Form 508.

- Provide the name under which the corporation is incorporated.

- Include the date the foreign corporation was authorized to transact business in Michigan.

- Choose the type of action requested from the Department of Licensing and Regulatory Affairs: either 'Dissolution' or 'Withdrawal from the State of Michigan.'

- Indicate how your corporation files the Michigan Annual Report by selecting either 'Profit' or 'Non-Profit.'

- If your corporation is undergoing a 12-month liquidation, mark 'Yes' and specify the date liquidation will be complete.

- Provide a detailed explanation if your corporation had no tax liability or was not required to register with the Michigan Department of Treasury, and substantiate with attachments if needed.

- Indicate if there is a corporation assuming assets or continuing the activity of your corporation. If 'Yes,' provide their name, FEIN, address, city, state, and ZIP code.

- Certification: Sign the form to declare that you are the owner, officer, or member of the business requesting the tax clearance.

- Enter your printed name, title, telephone number, contact address, and date.

- Attach a copy of your final tax returns with proof of payment. Submit the completed form by mailing it to the Tax Clearance Section, Michigan Department of Treasury.

Complete the Tax Clearance Certificate Sample online to ensure your corporation's compliance and successful dissolution or withdrawal.

Steps to apply for certificate of tax exemption. Proceed to the Taxpayer Service Section and submit the requirements for the certificate of tax exemption. Pay the certification fee (Php 100) and documentary stamp tax (Php 15). Receive the certificate from the BIR officer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.