Loading

Get Michigan K 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Michigan K 1 online

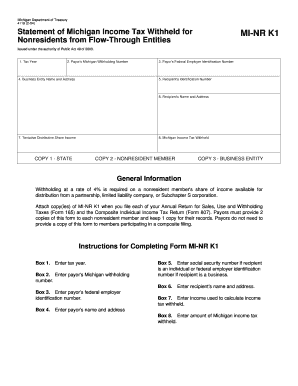

The Michigan K 1 form, officially known as the Statement of Michigan Income Tax Withheld for Nonresidents from Flow-Through Entities, is essential for reporting income tax withheld from nonresident members. This guide provides clear, step-by-step instructions on how to effectively fill out the form online, ensuring compliance and accuracy.

Follow the steps to complete the Michigan K 1 form online.

- Press the ‘Get Form’ button to access the Michigan K 1 form and open it in your browser.

- Begin by entering the tax year in Box 1, which specifies the year for which the income tax was withheld.

- In Box 2, input the payor's Michigan withholding number, which identifies the entity responsible for withholding the tax.

- Fill in Box 3 with the payor's federal employer identification number to associate the withheld tax with the correct business entity.

- In Box 4, provide the name and address of the payor to ensure accurate identification of the entity. This information is crucial for tax records.

- Move to Box 5 and enter the recipient's identification number, which could be the social security number for individuals or the federal employer identification number for businesses.

- Fill out Box 6 with the recipient's name and address to clearly identify the person or entity receiving the income.

- In Box 7, input the tentative distributive share income, which is the income used to calculate the income tax withheld under Michigan law.

- Finally, in Box 8, enter the amount of Michigan income tax that has been withheld, ensuring that the figure accurately represents the withholding from the income distribution.

- Once all sections are completed, you can save your changes, download the document, print it, or share it as needed.

Complete your documents online with ease and ensure timely filing.

If an MI-1040 is required, include copies of the following: Schedule K-1 (Form 1041) including footnotes. The letter received from the fiduciary notifying the beneficiary of Michigan adjustments or Michigan income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.