Loading

Get Il 1120 X Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL 1120 X Form online

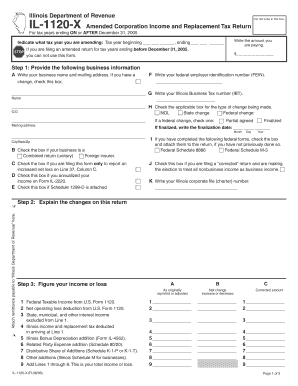

The IL 1120 X Form is an amended corporation income and replacement tax return used to correct previously filed returns. This guide provides clear, step-by-step instructions for completing the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to complete the IL 1120 X Form effortlessly.

- Click the 'Get Form' button to download the IL 1120 X Form and open it in the editor.

- Provide the necessary business information. Enter your business name and mailing address in the designated fields. If there are any changes to this information, make sure to check the corresponding box.

- Input your federal employer identification number (FEIN) and Illinois Business Tax number (IBT). Make sure these are accurate to avoid processing delays.

- Indicate the tax year you are amending. Fill in the beginning and ending dates correctly to reflect the year of the return you are modifying.

- Detail the changes being made. In this section, explain any alterations to federal taxable income, net operating loss deductions, or other relevant figures.

- Click checkboxes for specific conditions that apply to your return, including if you are filing for an increased net loss or annualized your income.

- Proceed to calculate your income or loss by filling in the amounts for each line item based on your adjustments.

- Complete the base income or loss section by subtracting total subtractions from your total income.

- If applicable, allocate your income to Illinois by totaling your business income or loss and completing any related calculations.

- Determine your net income and replacement tax by following the provided calculations in the designated sections.

- Finalize by figuring out your refunds or balances due. List any payments you've made and calculate the net amount.

- Sign the form. Make sure the authorized officer and preparer have signed and dated the form.

- Once completed, users can save their changes, download the form, print a hard copy, or share it as needed.

Complete your IL 1120 X Form online and ensure your amendments are filed accurately.

Related links form

The corporation must file its Form 1120X with the IRS Service Center where it filed the original return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.