Loading

Get 2011 Il 1041 X Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 IL-1041 X form online

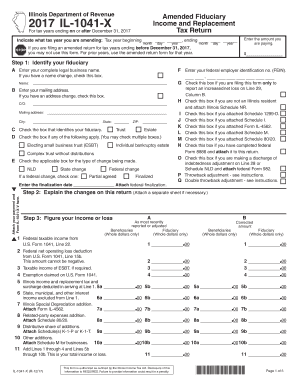

Filling out the 2011 IL-1041 X form online is essential for fiduciaries seeking to amend their income and replacement tax returns. This guide provides a detailed, step-by-step approach to help users navigate each section of the form effectively.

Follow the steps to complete your IL-1041 X form online.

- Click 'Get Form' button to obtain the form and open it in your editor.

- Identify your fiduciary by entering your complete legal business name, mailing address, and federal employer identification number (FEIN). Check the appropriate boxes for any changes.

- Indicate the tax year you are amending by filling in the beginning and ending dates. Ensure accurate entry to avoid complications.

- Enter the amount you are paying, if applicable, in the designated field.

- Explain any changes made by attaching a separate sheet if necessary. This is crucial for clarity and documentation.

- Figure your income or loss by completing the required fields for federal taxable income and other relevant financial data.

- Calculate your base income or loss by entering amounts from previous steps and ensuring all subtractions are correctly factored in.

- Determine your net income by following the instructions and entering nonresident adjustments if necessary.

- Complete and review the remaining calculations for net replacement tax and net income tax as applicable.

- In the final step, review all information, save your changes, and download, print, or share the form as needed.

Start filling out your 2011 IL-1041 X form online today for a smooth and efficient amendment process.

If an irrevocable trust has its own tax ID number, then the IRS requires the trust to file its own income tax return, which is IRS form 1041. During the lifetime of the grantor, any interest, dividends, or realized gains on the assets of the trust are taxable on the grantor's 1040 individual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.