Loading

Get Idaho Form 41

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Form 41 online

This guide provides clear and supportive instructions for filling out the Idaho Form 41 online. Whether you are familiar with tax forms or new to the process, you will find step-by-step guidance to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Idaho Form 41 online.

- Press the ‘Get Form’ button to access the form and open it in an online editor.

- Begin by entering the business name and your federal employer identification number (FEIN) at the top of the form.

- Specify the tax year for which you are filing, noting whether it is a calendar or fiscal year.

- Fill in the business mailing address, including the city, state, and ZIP code.

- Indicate if a name change has occurred, and specify if it is a combined report.

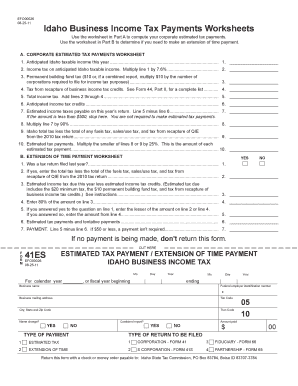

- In Part A, use the corporate estimated tax payments worksheet to compute your anticipated Idaho taxable income and taxes.

- For line 1, enter your anticipated taxable income for the year. This will be the starting point for your calculations.

- On line 2, calculate and input the income tax on the anticipated taxable income by multiplying line 1 by 7.6%.

- Proceed through the worksheet, completing each line by following the calculations specified for lines 3 to 10 related to various tax credits and payments.

- If applicable, complete Part B for any extension of time payments, answering the questions and entering the necessary figures.

- Review all provided information for accuracy to ensure compliance with Idaho tax regulations.

- Once you have filled out the form, you can save your changes, download a copy for your records, print the form, or share it as needed.

Take the next step in managing your finances by filing your Idaho Form 41 online today.

Sales taxes Idaho's state sales tax is 6%. Sales tax applies to the sale, rental or lease of tangible personal property and some services. Sales of food are taxed, for example, but sales of prescription drugs are not.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.