Loading

Get Delaware Form 700 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Form 700 2012 online

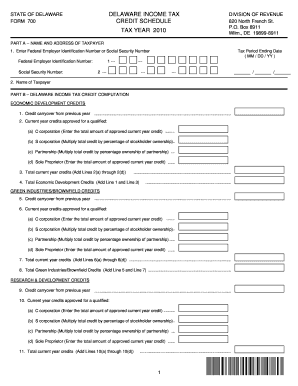

Filling out the Delaware Form 700 is a crucial step for entities looking to claim various income tax credits. This guide provides a clear, step-by-step process to assist users of all experience levels in completing the form online efficiently.

Follow the steps to fill out the Delaware Form 700 2012 online.

- Click ‘Get Form’ button to download the form and open it in your online editor.

- Enter your Federal Employer Identification Number or Social Security Number in the designated field.

- Provide the tax period ending date in the MM/DD/YY format.

- Complete your name as the taxpayer in the specified section.

- Move to Part B for Delaware income tax credit computation, beginning with economic development credits.

- Input the credit carryover from the previous year as indicated.

- Enter any current year credits approved for qualified entities, ensuring to specify amounts for C corporation, S corporation, partnership, and sole proprietor accordingly.

- For each type of credit, add the current year credits from sub-sections (a) through (d) and calculate the total current year credits.

- Sum the total current year credits with the credit carryover to identify total economic development credits.

- Repeat this process for green industries/brownfield credits, research & development credits, land & historic resource conservation credits, historic preservation credits, and other relevant sections.

- Once all totals have been determined, calculate and enter the total Delaware non-refundable and refundable business tax credits as directed.

- Review all entries for accuracy before finalizing.

- Finally, save your changes, and choose to download, print, or share the completed form as required.

Complete your Delaware Form 700 online to ensure you claim the credits you are eligible for.

Related links form

A: Resident individuals and resident businesses must file an annual return, even if no tax is due. Non-resident individuals who have income earned in Delaware that is not subject to employer withholding must file an annual return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.