Loading

Get Form Au 741

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Au 741 online

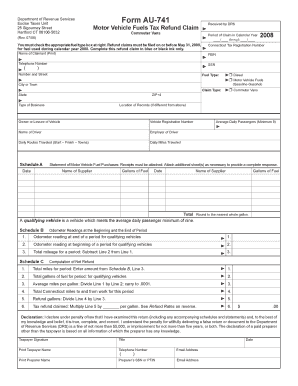

Filing a motor vehicle fuels tax refund claim can be a straightforward process when you understand each part of the Form Au 741. This guide will walk you through the steps needed to accurately complete the form online, ensuring you provide the necessary information to receive your refund without delay.

Follow the steps to fill out the Form Au 741 online for your tax refund.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Enter the period of claim in the designated fields, specifying the start and end dates for the calendar year.

- Select the appropriate fuel type by checking the corresponding box for diesel or motor vehicle fuels (gasoline-gasohol).

- Provide your Connecticut Tax Registration Number, Federal Employer Identification Number (FEIN), or Social Security Number (SSN) as requested.

- Complete the claimant's details, including your name, telephone number, and address.

- Indicate the claim type as 'Commuter Vans' and specify the type of business if applicable.

- Provide the location of records if it differs from the above address.

- Fill in the vehicle registration number, driver’s name, and employer of the driver.

- Document the daily routes traveled, including start, finish points, and towns.

- Enter the daily miles traveled and average daily passengers, ensuring a minimum of nine passengers.

- List the statement of motor vehicle fuel purchases with receipts attached. Include all necessary details such as date, name of supplier, and gallons of fuel.

- In Schedule B, fill in the odometer readings at the beginning and end of the period for qualifying vehicles.

- Complete Schedule C by calculating the total miles and gallons of fuel for the period and derive the average miles per gallon.

- Determine total Connecticut miles to and from work for the period and calculate the refund gallons.

- Multiply the refund gallons by the tax refund rate applicable for your fuel type as indicated and enter the total refund amount.

- Sign and date the form, and provide required contact details. If applicable, fill in paid preparer's information.

- Finally, save your changes, and choose to download, print, or share the completed form.

Complete your Form Au 741 online today for a smooth refund process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.