Loading

Get Form 472 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 472 Fillable online

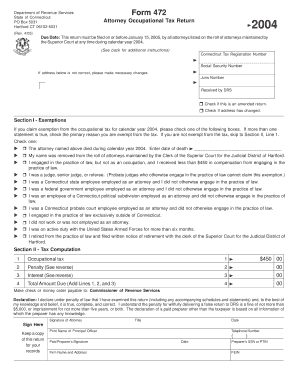

Filling out the Form 472 Fillable online requires careful attention to detail. This guide provides step-by-step instructions for each section of the form to help users complete it accurately and efficiently.

Follow the steps to complete the Form 472 Fillable online.

- Click the ‘Get Form’ button to download the form and open it in your preferred editing software.

- Enter your Connecticut Tax Registration Number and Social Security Number in the designated fields. If either number is incorrect, cross it out and write the correct number.

- Fill in your Juris Number. If you do not have this information, refer to your Attorney Registration form or the Connecticut Judicial Branch website.

- Indicate if this is an amended return by checking the appropriate box if applicable.

- If your address has changed, check the box indicating the change and ensure the new address is correct on the form.

- Proceed to Section I to claim any exemptions from the occupational tax. Select the appropriate box for your exemption status. If you are not claiming any exemptions, skip to Section II.

- In Section II, calculate your occupational tax by entering the amount due on Line 1. Add any penalties and interest on their respective lines.

- Sum the amounts from Lines 1, 2, and 3 to find the total amount due, which should be entered on Line 4.

- Complete the declaration section by signing and dating the form. If applicable, include information for your paid preparer.

- Once you have filled out the form, review it for accuracy. Save your changes, and you may also download, print, or share the completed form as needed.

Complete your Form 472 Fillable online today to ensure timely submission.

Related links form

Make your check payable to Commissioner of Revenue Services. To ensure proper posting of your payment, write “2022 Form CT‑1040" and your SSN(s) (optional) on the front of your check. Sign your check and paper clip it to the front of your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.