Loading

Get Form Eft 001 Alabama

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Eft 001 Alabama online

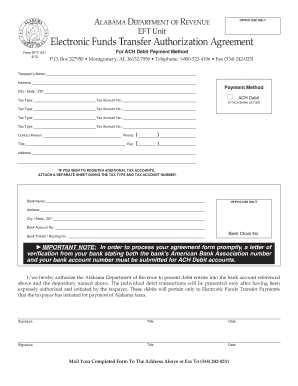

Filling out the Form Eft 001 Alabama online is a straightforward process that allows taxpayers to transition from the ACH Credit Method to the ACH Debit Method for their tax payments. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the Form Eft 001 Alabama

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the taxpayer’s legal name and mailing address. Ensure this information is accurate as it will be used for official correspondence.

- Specify the type of tax you are reporting. Examples include Sales Tax, Business Privilege, or Corporate Income Tax. Be precise to avoid processing delays.

- Input your tax account number that correlates with the tax type indicated. Avoid submitting your Social Security Number as it is not needed.

- Designate a contact person including their title, phone number, fax number, email, and address. This individual will be the point of contact for any queries regarding your EFT payment.

- Sign the form in the designated area. The authorization must be signed by the taxpayer or an authorized officer.

- If you intend to register additional tax accounts, provide the relevant tax type and account number on a separate sheet and attach it.

- Attach a bank letter for verification that includes both the bank’s American Bank Association number and your bank account number to process your request efficiently.

- Review your completed form for accuracy. Once verified, you can save changes, download, print, or share the form as needed.

Complete your Form Eft 001 Alabama online today to ensure a smooth transition to the ACH Debit Method.

Pay your taxes due on E-Filed and Paper Returns, Assessments and Invoices. Pay via Credit/Debit card and ACH online with MyAlabamaTaxes or Pay Bill. Mail your payment. Payments for Billing Letters, Invoices or Assessments should be mailed to the address found on the letter, invoice or assessment. Mailing Addresses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.