Loading

Get Otc 987

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Otc 987 online

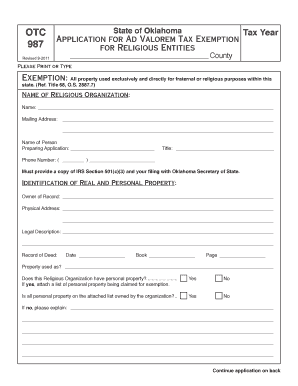

The Otc 987 form is an application for ad valorem tax exemption for religious entities in the state of Oklahoma. This guide will provide you with clear and detailed instructions on how to fill out this form online, ensuring that your application is complete and accurate.

Follow the steps to complete the Otc 987 application

- Press the ‘Get Form’ button to obtain the Otc 987 form and access it in your online document editor.

- Carefully read the exemption criteria, which states that all property must be used exclusively and directly for fraternal or religious purposes.

- Fill in the name of the religious organization in the designated field, along with the complete mailing address.

- Provide the name and title of the person preparing the application, as well as their phone number.

- Identify the owner of record and provide the physical address of the property being claimed for exemption.

- Complete the legal description and record of deed sections, including the date, book, and page number.

- Indicate the specific use of the property being claimed, and answer if the organization has personal property that qualifies for exemption.

- Attach a detailed list of personal property if applicable, ensuring to confirm ownership by the organization.

- Respond to each of the written explanations requested regarding the exact usage of the property and the income derived from it.

- Attach all necessary supporting documents, such as articles of incorporation and IRS Section 501(c)(3) documentation.

- Provide the name and contact details of the person who may be contacted for additional information if needed.

- Carefully review all entered information for accuracy and completeness before saving your changes. You can then download, print, or share your completed form as needed.

Complete your Otc 987 application online today to ensure your organization receives the appropriate tax exemptions.

Oklahoma 100% Disabled Veteran Property Tax Exemption: Oklahoma offers a 100% property tax exemption for eligible disabled Veterans and their Surviving Spouse. This exemption is for the full fair cash value of the homestead.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.