Loading

Get State Of Michigan Forms 2796

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Michigan Forms 2796 online

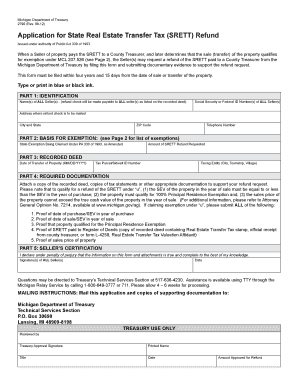

Filling out the State Of Michigan Forms 2796 online is a straightforward process designed to assist sellers seeking a refund of the State Real Estate Transfer Tax. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete your refund request.

- Click ‘Get Form’ button to retrieve the form and access it in your browser.

- In Part 1, enter the names of all sellers as they appear on the recorded deed. Make sure to provide accurate social security or federal ID numbers for each seller, along with the address where the refund check should be sent, including city, state, and ZIP code. Don’t forget to add a valid telephone number.

- Move to Part 2 to indicate the basis for the exemption. Here, clearly state the exemption you are claiming under Public Act 330 of 1993, as amended, and enter the amount of the SRETT refund you are requesting.

- In Part 3, fill in the details about the recorded deed. Provide the date of transfer in the format MM/DD/YYYY, include the tax parcel or sidwell ID number, and specify the taxing entity such as the city, township, or village.

- Part 4 requires you to attach necessary documentation to support your refund request. Ensure you include a copy of the recorded deed, the tax statements, and any other relevant documents. If claiming exemption under section ‘u’, provide all required proofs as listed in the guidelines.

- Finally, in Part 5, complete the seller's certification by signing the form. All sellers must sign and date the document to confirm the accuracy of the information provided.

- After filling out the form, save any changes made. You can then download, print, or share the completed form based on your preference before submitting it.

Start the process online now to ensure you complete your form accurately and efficiently.

MICHIGAN REAL ESTATE TRANSFER TAX The tax shall be upon the person who is the seller or the grantor. In the case of an exchange of two properties the deeds transferring title to each are subject to tax, and in each case shall be computed on the basis of the actual value of the property conveyed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.