Loading

Get Idr 54 269a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idr 54 269a online

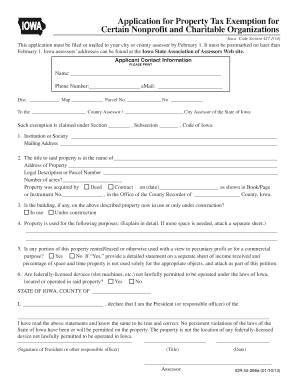

Filling out the Idr 54 269a form online can be a straightforward process with the right guidance. This comprehensive guide will walk you through each step to ensure your application for property tax exemption is completed accurately and efficiently.

Follow the steps to complete your application with ease

- Click the ‘Get Form’ button to access the Idr 54 269a form and open it in your online editor.

- Begin by filling out the applicant contact information. Provide your name, phone number, and email address clearly. Additionally, you should indicate the district, map, and parcel number associated with the property.

- Address the form to the appropriate county or city assessor by specifying their title and name.

- Indicate the specific section and subsection under which you are claiming the exemption from property tax.

- Provide details about your institution or society, along with its mailing address. Ensure all information is accurate to avoid any delays.

- Fill out the section regarding the title of the property and its address. Include the legal description or parcel number and the number of acres the property encompasses.

- Indicate how the property was acquired—whether by deed or contract—and include the relevant date and identification numbers as shown in recorded documents.

- Specify whether the building is currently in use or under construction by selecting the appropriate option.

- Describe the property’s intended purposes in detail. If necessary, attach an additional sheet to provide more information.

- Answer the question about any portion of the property being rented or leased for commercial gain, and if so, submit a detailed statement on a separate sheet.

- Indicate if any federally-licensed devices are located or operated on the property, responding with 'Yes' or 'No.'

- Complete the declaration section by providing the name of the responsible officer and signing the form. Ensure the title and date are also filled in.

- Once all fields are completed, save your changes, and consider downloading or printing a copy of the completed form before submission.

- Submit your form to the appropriate assessor by the deadline of February 1, ensuring it is postmarked by this date.

Start filling out your Idr 54 269a form online today to ensure your tax exemption application is submitted on time.

To write a radio or TV program proposal, you should include the following a general overview of the program concept; an explanation of why it will be of interest to viewers; an outline of the topics that will be covered; a list of potential guests, experts, or commentators; a budget for producing the program; a ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.