Loading

Get Ct 1065 Extension

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 1065 Extension online

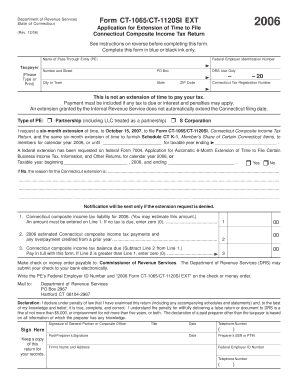

Filing the Ct 1065 Extension is an essential step for pass-through entities seeking to extend their time to file the Connecticut Composite Income Tax Return. This guide offers a clear, step-by-step overview to help you successfully navigate the online form-filling process.

Follow the steps to complete your Ct 1065 Extension online.

- Click the ‘Get Form’ button to access the Ct 1065 Extension form and open it in your preferred editing tool.

- Begin by entering the name of your pass-through entity in the designated field. Ensure accuracy in spelling and details.

- Input the Federal Employer Identification Number in the provided field. This number is crucial for tax identification purposes.

- Complete your entity's address, including street number, P.O. Box (if applicable), city or town, state, and ZIP code. Accuracy in this section ensures proper communication from tax authorities.

- Indicate your Connecticut Tax Registration Number if applicable, ensuring all required fields are populated.

- Select the type of pass-through entity by checking the appropriate box for either partnership (including LLC treated as a partnership) or S Corporation.

- Request the six-month extension by confirming the date to which you are seeking an extension. Fill in the date accurately, ensuring it adheres to the guidelines provided.

- If a federal extension has been requested, indicate this by checking 'Yes'. If 'No', provide the reason for your request in the space provided.

- Calculate your Connecticut composite income tax liability for the year and enter the amount on Line 1. If there is no tax due, enter zero.

- Enter any 2006 estimated Connecticut composite income tax payments and overpayment credits from a prior year on Line 2.

- Calculate the balance due by subtracting Line 2 from Line 1 and enter this amount on Line 3. If Line 2 exceeds Line 1, enter zero.

- Prepare your payment to the Commissioner of Revenue Services if there is a balance due. Ensure to follow the instruction provided regarding the payment method.

- Sign and date the form in the designated area. The signature must be from a general partner or corporate officer.

- If applicable, have the paid preparer sign the form and fill in their required information.

- Once completed, save your changes, then download, print, or share the form as necessary before mailing it to the Department of Revenue Services.

Complete your Ct 1065 Extension form online today to ensure a smooth filing process.

If federal Form 7004 was not filed, the PE can apply for a six-month extension to file Form CT-1065/CT-1120SI if there is reasonable cause for the request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.