Loading

Get Application For Florida Consolidated Number Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Florida Consolidated Number Form online

Filling out the Application For Florida Consolidated Number Form can streamline your sales and use tax reporting for multiple business locations. This guide provides clear, step-by-step instructions to ensure you accurately complete the form online, optimizing your tax management process.

Follow the steps to complete the Application For Florida Consolidated Number Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

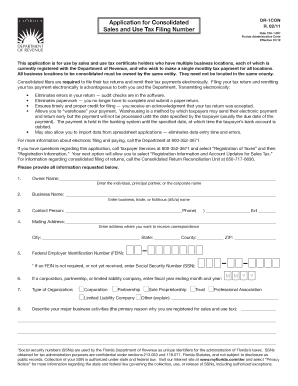

- Enter the owner name in the designated field. This should include the individual's name, principal partner, or corporate name associated with the business.

- Fill in the business name. This is the name under which you conduct your business, including any trade or fictitious names.

- Provide the contact person's details. This includes their name, phone number, and extension if applicable.

- Complete the mailing address section accurately. Specify where you would like to receive correspondence regarding your application.

- Enter the federal employer identification number (FEIN). If one is not available, provide your social security number (SSN) instead.

- If applicable, indicate the fiscal year ending month and year for your corporation, partnership, or limited liability company.

- Select the type of organization from the provided options such as corporation, partnership, or sole proprietorship.

- Describe the principal activities of your business that require sales and use tax registration.

- Indicate the month of your first consolidated filing, keeping in mind that the effective date is the first of the month.

- List all sales and use tax numbers for each of your business locations to be reported under the consolidated number. Attach additional sheets if necessary.

- Ensure the application is signed by the business owner, principal partner, or corporate officer. The application cannot be processed without a signature.

- Lastly, save your changes, then download, print, or share the completed form as required.

Complete your Application For Florida Consolidated Number Form online today.

Related links form

You must complete and submit Form DR-1 to register to collect, accrue, report, and pay the taxes, surcharges, and fees listed below if you engage in any of the activities listed beneath each tax or fee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.