Loading

Get 301 Ef Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 301 Ef Form online

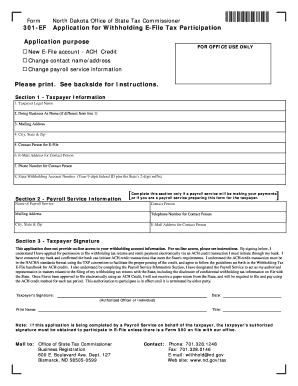

The 301 Ef Form is essential for registering for the E-File tax participation program with the North Dakota Office of State Tax Commissioner. This guide provides a clear, step-by-step approach to successfully complete the form online, ensuring you provide all necessary information accurately.

Follow the steps to complete the 301 Ef Form online

- Press the ‘Get Form’ button to access the 301 Ef Form and open it in your document editor.

- In Section 1, provide your taxpayer information: enter your legal name, any doing business as name, and your complete mailing address including city, state, and zip code. Additionally, include the contact person for the E-File, their email address, phone number, and your state withholding account number.

- If you are using a payroll service, move to Section 2. Fill in the payroll service information by entering the service name, service ID including the state's suffix, contact person details, mailing address, telephone number, email address, and city, state, and zip code.

- Proceed to Section 3 for taxpayer signature. Ensure you understand the implications of the application, and sign where indicated. Include your title and print your name. If a payroll service is completing the form, ensure the taxpayer’s signature is obtained unless a Form 500 is on file.

- Review all information filled in the form for accuracy. Once confirmed, you can save changes, download, print, or share the completed form.

Complete and submit your 301 Ef Form online today to streamline your tax filing process.

Taxes may be paid in cash, by personal check, by money order, by credit card, by electronic bank transfer, or by ACH. Taxpayers may make credit card, electronic bank transfer, or ACH payments online using the North Dakota TAP system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.