Loading

Get Form Sfn 24777a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Sfn 24777a online

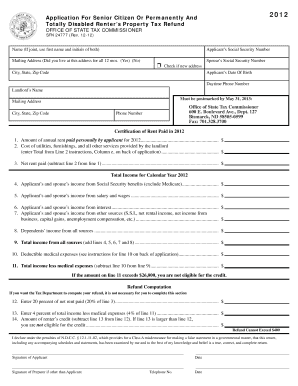

Filling out the Form Sfn 24777a can be a straightforward process when you have clear guidance. This form is designed for individuals seeking a tax refund related to property taxes as a senior citizen or a person with a disability. Follow the steps below to complete the form accurately and efficiently.

Follow the steps to successfully complete the Form Sfn 24777a online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your name in the designated field. If this is a joint application, include the first name and initials of both applicants.

- Input the applicant’s Social Security Number in the provided section.

- Fill out your mailing address and confirm if you lived at this address for all twelve months. Indicate your status by checking 'Yes' or 'No.'

- If applicable, check the box to indicate that this is a new address.

- Provide the city, state, and zip code of your mailing address.

- If there is a spouse, include their Social Security Number and date of birth.

- Enter your daytime phone number for contact purposes.

- Input the landlord's name and their mailing address, followed by the city, state, and zip code.

- Include the landlord's phone number for correspondence.

- Note the deadline for mailing the completed form, which must be postmarked by May 31, 2013.

- Proceed to the 'Certification of Rent Paid in 2012' section. Input the total rent paid personally by the applicant in the appropriate field.

- Complete the cost of utilities, furnishings, and other services provided by the landlord as instructed.

- Calculate and enter the net rent paid — this is the amount from line 1 subtracted by line 2.

- Move to the 'Total Income for Calendar Year 2012' section and provide the necessary income details from Social Security, salary, interest, and any other sources.

- List dependent income from all sources, if applicable, and calculate the total income.

- Document any deductible medical expenses that have been incurred during the year.

- Finally, calculate the total income less medical expenses for eligibility determination.

- If you want the Tax Department to compute your refund, you may skip the 'Refund Computation' section; otherwise, fill out the details as requested.

- Sign and date the form. If someone else prepared the form, they should sign and include their contact number.

- After completing the form, save your changes. You may also download, print, or share the completed form as needed.

Complete your Form Sfn 24777a online today to ensure you receive the tax refund you may be eligible for.

You can use either asterisks or visual indicators to mark the required fields. As a UX Designer, I always recommend marking all required form fields as required, unless there is a specific reason not to.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.