Loading

Get New Jersey Form St 6b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Jersey Form St 6b online

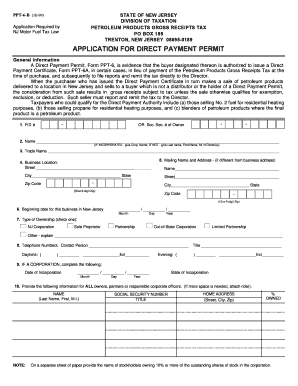

This guide provides a clear and concise overview of how to accurately complete the New Jersey Form St 6b, which is essential for those applying for a Direct Payment Permit under the New Jersey Motor Fuel Tax Law. Following the outlined steps will ensure that you navigate the online form with ease, making the process smoother and more efficient.

Follow the steps to successfully complete the New Jersey Form St 6b online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Federal Identification Number (FID) or Social Security Number (SSN) of the owner in the designated field.

- Input the name of the business or individual applying. If incorporated, provide the corporation name; otherwise, include the last name, first name, and middle initial of the owner.

- Enter the trade name of your business in the appropriate section.

- Provide the complete business location, including street, city, state, and zip code.

- If the mailing address is different from the business address, complete the mailing name and address section.

- Indicate the date when the business began operating in New Jersey.

- Select the type of ownership by checking the appropriate box—for instance, NJ Corporation, Sole Proprietor, or others.

- If applicable, fill in the date of incorporation and the state of incorporation for your business.

- List all owners, partners, or corporate officers, including their names, social security numbers, titles, home addresses, and ownership percentages in the detailed section.

- Provide information on any parent companies, subsidiaries, or affiliates associated with your business.

- Input the name, title, and address of your agent in New Jersey for service purposes.

- List your suppliers of petroleum products in the designated field.

- Indicate if you are registered with the Division of Taxation for other New Jersey State taxes and list them if applicable.

- Select your type of business activity by checking one of the provided boxes.

- Detail your business operations and explain why you qualify for a Direct Payment Permit.

- If applicable, describe the types of petroleum products to be blended and their respective percentages.

- Sign and date the application to certify that all information is accurate. Ensure that the signature corresponds to the name of the owner, partner, or officer.

Complete your New Jersey Form St 6b online today for a hassle-free filing experience.

You have two options to register your business for a sales tax permit in New Jersey: online and filling out forms and mailing them in. For sellers who live in New Jersey, we recommend registering online. To register online, head to the New Jersey Business Registration Page page.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.