Loading

Get Health Savings Account Mistaken Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account Mistaken Distribution Form online

Filling out the Health Savings Account Mistaken Distribution Form is an important step for correcting any mistaken distributions related to your health savings account. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to obtain the Health Savings Account Mistaken Distribution Form and open it in your online editor.

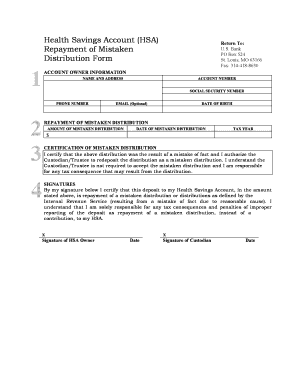

- In the 'Account Owner Information' section, fill in your name and address, ensuring that all details are accurate. This will help identify your account correctly.

- Enter your account number and social security number in the respective fields. Double-check these numbers for correctness to avoid any delays.

- Optional: If you wish, provide your phone number and email address for further communication. This can be beneficial if additional information is needed.

- Fill in your date of birth in the designated area. This information is necessary for personal verification.

- In the 'Repayment of Mistaken Distribution' section, specify the amount of the mistaken distribution that you are repaying. Precision is vital here.

- Indicate the date of the mistaken distribution and tax year related to it. This helps the custodian to process your repayment accurately.

- In the 'Certification of Mistaken Distribution' section, read the acknowledgment carefully. Your certification supports the authorization of the custodian/trustee to redeposit the mistaken distribution.

- Sign the form where indicated as the HSA owner. Also, date your signature to confirm the authenticity of the document.

- If applicable, have the custodian/trustee sign the form in the designated area and include the date of signature.

- After completing the form, you can save your changes. Options to download, print or share the completed form may be available to ensure you have a copy for your records.

Complete your Health Savings Account Mistaken Distribution Form online today for a smoother process.

A Box 1: Gross Distribution Total amount paid to retiree in 2019 before taxes or other deductions does not inc. Page 1. A Box 1: Gross Distribution Total amount paid to retiree in 2019 before taxes or other deductions does. not include health insurance reimbursements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.