Loading

Get 592 Form 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 592 Form 2011 online

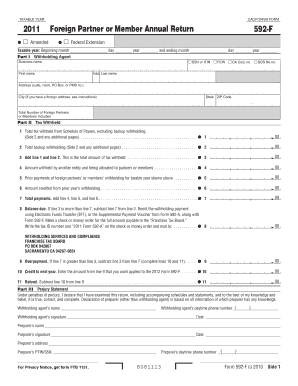

Filling out the 592 Form 2011, the foreign partner or member annual return, online is a straightforward process. This guide will provide you with a clear, step-by-step approach to successfully complete the form from start to finish.

Follow the steps to complete the 592 Form 2011 online:

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the taxable year details, including the beginning and ending months and days, along with the year, in the designated fields.

- In Part I, provide the withholding agent's information. Enter the appropriate identification numbers (SSN, ITIN, FEIN, CA Corp no., SOS file no.), business name, and withholding agent's address including city, state, and ZIP code.

- Indicate the total number of foreign partners or members included in the report.

- Proceed to Part II and enter the tax withheld amounts. Start with line 1, which requires the total tax withheld from the schedule of payees, excluding any backup withholding.

- Complete line 2 by entering any backup withholding amounts.

- Add the amounts from lines 1 and 2, and write the total on line 3.

- Continue filling in the relevant information for lines 4 to 8 regarding amounts withheld by other entities, prior payments, and any overpayment.

- In Part III, fill out the perjury statement, including the withholding agent's name, daytime phone number, signature, and date.

- If applicable, fill in the preparer's information and their signature, along with the PTIN/SSN and daytime phone number.

- Review the completed form for accuracy.

- Once everything is filled out, save your changes, and choose to download, print, or share the form as necessary.

Start filling out your 592 Form 2011 online today for a seamless experience.

Purpose. Use Form 587, Nonresident Withholding Allocation Worksheet, to determine if withholding is required and the amount of California source income subject to withholding. ... The payee is a resident of California or is a non-grantor trust that has at least one California resident trustee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.