Loading

Get Form 592

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 592 online

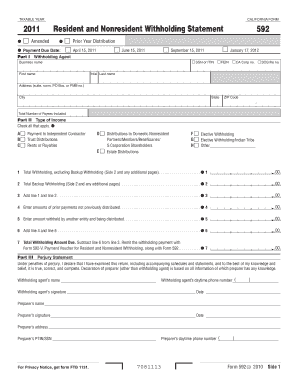

Filling out Form 592, the resident and nonresident withholding statement, online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form to ensure accurate and complete completion.

Follow the steps to successfully complete the Form 592 online.

- Click ‘Get Form’ button to access the form and open it in your chosen editing platform.

- Begin by entering the taxable year at the top of Form 592. Make sure this matches the calendar year for which you are reporting withholding.

- In Part I, enter the withholding agent's information, including their business name, ID number, and address. If applicable, enter the DBA (doing business as) name.

- Provide the total number of payees included in the Schedule of Payees.

- In Part II, check all types of income that apply. This could include payments to independent contractors, trust distributions, and more.

- Fill in the total amounts for withholding on Lines 1 and 2, and calculate the total on Line 3. Ensure these figures are accurate as they represent withholding from the Schedule of Payees.

- Continue with Lines 4 and 5, reporting any prior payments not yet distributed and amounts withheld by other entities respectively.

- Subtract the sum from Line 6 from the total on Line 3 to find the total withholding amount due on Line 7.

- In Part III, complete the perjury statement by providing the withholding agent's and preparer's names, signatures, and contact information.

- Fill out the Schedule of Payees on Side 2, inputting the required information for each payee, including their name, addresses, and amounts withheld.

- Once all sections are completed, save your changes. You can then download, print, or share the form as necessary.

Get started on completing your Form 592 online today!

Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.