Loading

Get Tax Dependent Worksheet Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Dependent Worksheet Fillable Form online

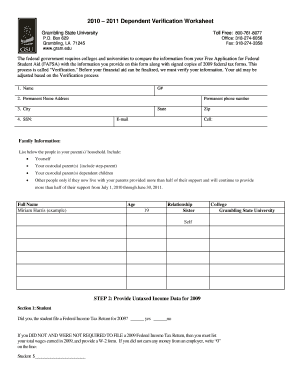

Filling out the Tax Dependent Worksheet Fillable Form online is an essential step in verifying your financial aid eligibility. This guide provides clear instructions for completing each part of the form to ensure a smooth submission process.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the Tax Dependent Worksheet Fillable Form and open it in your preferred editor.

- In the first section, enter your personal information. This includes your full name, student identification number (G#), permanent home address, personal phone numbers, email address, and social security number. Ensure that all details are accurate and current.

- Provide family information by listing all individuals in your custodial household. Include yourself, your custodial parent(s) (including any step-parent), dependent children, and anyone else receiving more than half of their support from your parents, if applicable.

- In the next section, indicate whether you, the student, filed a Federal Income Tax Return for the applicable year. If you did not file and were not required to, list your total wages earned and provide a W-2 form.

- Answer whether your parent or step-parent filed a Federal Income Tax Return. If they did not file and were not required to, document their total wages and supply the corresponding W-2 forms.

- List all untaxed income received by both you and your parents for the specified year. Ensure that you account for all relevant income sources and do not leave any fields blank.

- Gather all required documents, including signed copies of 2009 Federal Income Tax Returns. You may obtain these from your tax preparer or request a transcript from the IRS if necessary.

- Print the completed worksheet and sign it. Ensure both you and your parent sign and date the form, as missing signatures may delay your financial aid process.

- Finally, submit the completed form and all necessary documents to the Grambling State University Office of Student Financial Aid for processing.

Get started on completing your Tax Dependent Worksheet Fillable Form online today!

Related links form

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income (AGI) is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.