Loading

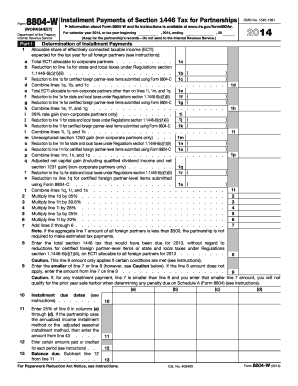

Get Form 8804 W 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8804 W 2011 online

This guide provides clear and supportive instructions for completing the Form 8804 W 2011 online. Whether you are a seasoned filer or a beginner, this step-by-step approach will assist you in navigating the form with confidence.

Follow the steps to fill out the Form 8804 W 2011 correctly.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Enter the tax year information in the provided fields for the partnership's records.

- In Part I, Section 1, fill out the allocable share of effectively connected taxable income (ECTI) expected for the tax year for all foreign partners, detail each relevant item.

- Complete the calculations for lines 2 through 6 using the appropriate rates for each category of partners, ensuring accurate summation of your inputs.

- Proceed to line 8, entering the total section 1446 tax that would have been due for the prior year.

- Follow through on lines 9 through 13, calculating estimated payments and any reductions as outlined in the form instructions.

- For Part II or Part III, enter ECTI for each annualization period as instructed, applying the necessary calculations and reductions.

- Complete parts IV as needed, ensuring the correct figures for required installments are reflected.

- At the conclusion of your form filling, save your changes, download a copy for your records, and print or share the completed form as needed.

Take the next step and complete your documents online today!

Late Filing of Form 8804 A partnership that fails to file Form 8804 when due (including extensions of time to file) can generally be subject to a penalty of 5% (0.05) of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% (0.25) of the unpaid tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.