Loading

Get W4s

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-4S online

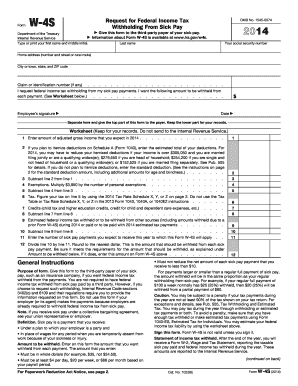

The W-4S form is essential for requesting federal income tax withholding from sick pay. This guide provides clear and supportive instructions on how to fill out the form accurately while managing your documents online.

Follow the steps to complete the W-4S form effectively.

- Press the ‘Get Form’ button to obtain the W-4S form and open it in your preferred editor.

- Type or print your first name, middle initial, and last name in the designated fields on the form. Ensure you also include your social security number.

- Fill in your home address, including the street number, city, state, and ZIP code. If applicable, include your claim or identification number.

- In the section labeled for federal income tax withholding, specify the amount you want withheld from each sick pay payment. Ensure this amount meets the specified criteria, such as being in whole dollars and not reducing your net payment below $10.

- Sign and date the form at the bottom. Remember, the form is not valid without your signature.

- Separate the form as instructed. Give the top part of the form to the payer of your sick pay and retain the lower part for your records.

- Review the worksheet section of the form for additional calculations you may need, such as projected income, deductions, and credits. Use these insights to ensure proper withholding amounts.

- Once all sections are completed, save your changes. Depending on your needs, you may download, print, or share the form as necessary.

Start filling out your W-4S form online today to ensure correct tax withholding from your sick pay.

Related links form

The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. Accurately completing your W-4 can help you prevent having a big balance due at tax time. ... In most cases, if you earn money, the IRS expects you to pay taxes on it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.