Loading

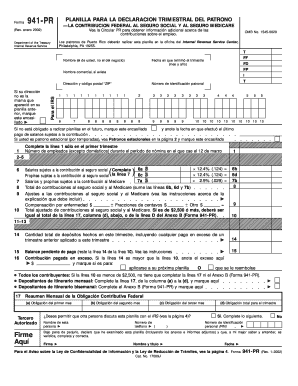

Get Form 941-pr (rev. January 2002) (fill-in Version). Planilla Para La Declaracion Trimestral Del

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 941-PR (Rev. January 2002) (Fill-in Version) Planilla Para La Declaracion Trimestral Del online

This guide provides a comprehensive walkthrough on how to fill out the Form 941-PR (Rev. January 2002) online. Users can successfully complete this essential quarterly tax declaration form for employers in Puerto Rico with ease.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- In the first section, enter your name (as an individual) and the end date of the quarter (month and year). If you have a business name, please include it in the designated field.

- Input your employer identification number (EIN) and your address along with the ZIP code.

- Indicate if your address has changed since your last submission by marking the appropriate box.

- For the first quarter, complete the first line with the number of employees (excluding domestic workers) who were employed during the payroll period ending on March 12.

- Enter the total wages subject to Social Security tax on line 6a and the total tips reported by employees subject to Social Security tax on line 6c.

- Fill in the salaries and tips subject to Medicare tax on line 7a.

- Calculate the total contributions for Social Security and Medicare on line 8 by adding the amounts from the previous lines.

- If applicable, make any adjustments to your contributions for Social Security and Medicare on line 9.

- Proceed to line 10 for the total adjusted contributions.

- Indicate the total deposits made during the quarter on line 14 and calculate any due balance on line 15.

- If you overpaid, record the excess amount on line 16 and choose whether to apply it to future forms or request a refund.

- Complete lines 17a to 17d if you are a monthly schedule depositor, otherwise you can skip this if your total obligation is below $2,500.

- Authorize a third party to discuss your form with the IRS if desired by marking the appropriate section and providing the necessary contact details.

- Finally, sign and date the form, including your printed name and title before submission.

- Once you have completed the form, you can save your changes, download, print, or share the form as needed.

Start filling out your Form 941-PR online today for fast and accurate submissions.

Related links form

How to fill out 941 Form Basic business information, such as your business's name, address, and Employer Identification Number (EIN) Number of employees you compensated during the quarter. Total wages you paid to employees in the quarter. Taxable Social Security and Medicare wages for the quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.