Loading

Get Form 1040a Year 2001 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1040a Year 2001 Online

Filing your taxes can be a straightforward process if you have the right guidance. This guide provides step-by-step instructions on how to fill out Form 1040a Year 2001 online, ensuring you understand each section and requirement easily.

Follow the steps to complete your Form 1040a Year 2001 online.

- Click the ‘Get Form’ button to acquire the Form 1040a Year 2001 and open it in your preferred online editor.

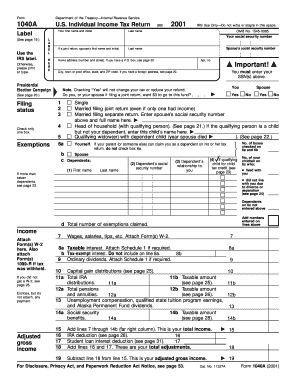

- Begin by entering your first name and initial in the designated field. If filing jointly, include your spouse's first name and initial as well.

- Select your filing status by checking only one box that applies to your situation, such as single or married filing jointly.

- Input your and your spouse’s Social Security numbers in the appropriate fields. This is essential for processing your tax return.

- Fill out your home address accurately, including your city, state, and ZIP code. If applicable, indicate if you have a P.O. box.

- Indicate if you would like to contribute $3 to the presidential election campaign fund by selecting 'Yes' or 'No'.

- List your dependents, if any, by providing their first names, last names, Social Security numbers, and their relationships to you.

- Calculate your total income by entering income sources such as wages, interest, dividends, and pensions. Attach any required forms as indicated.

- Determine your adjusted gross income by applying any eligible deductions, such as IRA deductions or student loan interest.

- Enter your standard deduction based on your filing status and subtract it from your adjusted gross income to find your taxable income.

- Calculate your tax using the tax tables provided, and ensure you account for any credits, such as child tax credits.

- Identify the total payments you have made, including federal income tax withheld and estimated tax payments.

- If you have an overpayment, specify the amount to refund or the amount owed if that applies.

- Finally, review all entries for accuracy, sign the declaration, and date the form. If filing jointly, both you and your spouse must sign.

- Once completed, save changes, download, print, or share the form as necessary.

Encourage others to complete their tax documents online for efficiency and accuracy.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.