Loading

Get Form 1040 Pr 2010 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1040 Pr 2010 Online

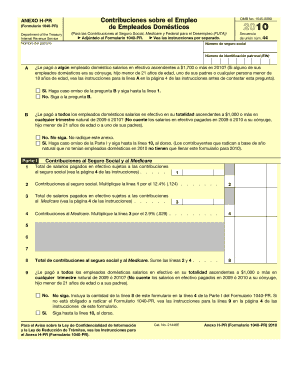

Filing the Form 1040 Pr 2010 Online can be straightforward with the right guidance. This guide aims to provide step-by-step instructions on how to complete the form accurately and efficiently.

Follow the steps to complete your Form 1040 Pr 2010 Online with ease.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your name and the identification number of your business, if applicable, in the designated fields.

- Address the first question regarding cash payments to domestic employees. If you paid an employee $1,700 or more in cash, answer 'Yes' and proceed to line 1. If not, answer 'No' and skip to question B.

- For question B, if you have paid all domestic employees a total of $1,000 or more in cash during any natural quarter in 2009 or 2010, answer 'Yes' and continue to line 10 on the back. If 'No,' do not file this form.

- In Part I, enter the total cash wages subject to social security contributions on line 1. Calculate the social security contribution by multiplying the amount on line 1 by 12.4% and record it on line 2.

- Similarly, enter the total cash wages subject to Medicare on line 3 and calculate the Medicare contribution (2.9% of line 3) to fill in line 4.

- Sum the contributions from lines 2 and 4 on line 8. Ensure to follow instructions carefully for each field.

- Proceed to the questions on whether to continue filling in further sections based on the rendered answers from previous questions.

- Complete Part II if applicable, focusing on FUTA contributions. Carefully fill in all relevant fields regarding contributions paid and employee wages.

- In Part III, add all applicable totals for domestic employee contributions. Ensure all entries are accurate and double-check your calculations.

- Finally, complete Part IV with your signature and date if required. Review the form for completeness and accuracy before submission.

- Once all sections are filled, you can save changes, download, or print the finalized form for your records or submission.

Start filling out your Form 1040 Pr 2010 Online today for a hassle-free filing experience.

Here are the three ways to get transcripts: Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. ... By phone. Taxpayers can call 800-908-9946 to request a transcript by phone. ... By mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.