Loading

Get Irs Form 12451

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 12451 online

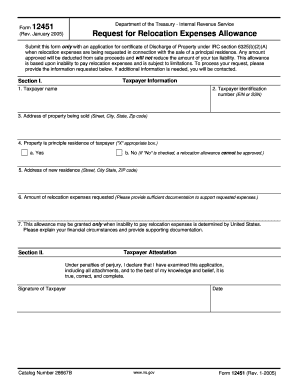

Filling out IRS Form 12451 is an essential step for individuals requesting relocation expense allowances related to the sale of their principal residence. This guide provides clear, step-by-step instructions to help users navigate the form confidently and correctly.

Follow the steps to complete the IRS Form 12451 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- In Section I, enter the taxpayer's full name.

- Provide the taxpayer identification number, which can either be an Employer Identification Number (EIN) or a Social Security Number (SSN).

- Fill in the address of the property being sold, including street address, city, state, and ZIP code.

- Indicate whether the property is the taxpayer's principal residence by marking the appropriate box: 'Yes' or 'No.' If 'No' is marked, the allowance cannot be approved.

- Input the address of the new residence, again providing the complete street address, city, state, and ZIP code.

- State the amount of relocation expenses being requested and ensure to attach sufficient documentation that supports the requested expenses.

- Explain your financial circumstances to establish the inability to pay relocation expenses and attach any supporting documentation.

- In Section II, sign the form under penalties of perjury, confirming the information is true and complete. Date the form.

- Once all sections are completed, save your changes, download the document, print it, or share it as needed.

Begin the process of filling out your IRS Form 12451 online today.

A qualified moving expense reimbursement is any amount received by an individual from an employer as a payment for or a reimbursement of expenses that would be deductible as moving expenses if paid directly by the individual.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.