Loading

Get Security Instrument

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Security Instrument online

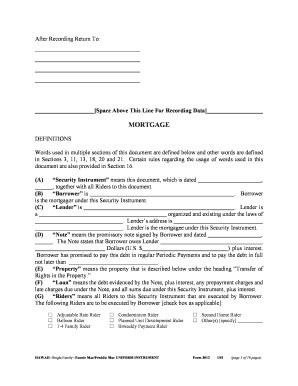

Filling out the Security Instrument is an important step in securing a loan. This guide provides a straightforward approach to completing the form online, ensuring you understand each component and its significance.

Follow the steps to properly complete the Security Instrument.

- Click the ‘Get Form’ button to obtain the Security Instrument and open it in your preferred editing tool.

- Identify the 'Borrower' section and provide the full name of the person or entity responsible for the loan. Ensure that the name is accurate as it appears in legal documents.

- In the 'Lender' section, enter the lender’s full name, and ensure you include their official address. This information must match the lender's legal records.

- Fill in the loan amount in the 'Note' section. This is the total amount borrowed, which should be precise, as it will dictate your repayment terms.

- Describe the 'Property'. Enter the property’s full address including street, city, state (Hawaii), and zip code where the loan will be secured.

- Choose the appropriate 'Riders' applicable to the loan by checking the boxes next to the relevant options. These riders may affect your loan terms.

- Review all filled information to ensure accuracy and completeness. Make sure all required fields are filled out to avoid delays.

- Once satisfied with your entries, save your changes. You then have the option to download, print, or share the completed Security Instrument.

Complete your documents online for a smoother process.

A security instrument is a legal document that gives someone the right to take action if certain conditions are not met. In business, security instruments are typically used to protect investments and ensure that creditors are paid. They can also be used to give shareholders a say in how the company is run.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.