Loading

Get Ira Single Withdrawal Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira Single Withdrawal Request Form online

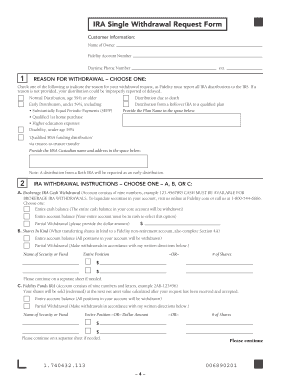

The Ira Single Withdrawal Request Form is essential for users seeking to withdraw funds from their IRA accounts. This guide provides you with a clear and user-friendly approach to completing the form online, ensuring a smooth process for your withdrawal request.

Follow the steps to successfully complete your withdrawal request.

- Click the 'Get Form' button to obtain the Ira Single Withdrawal Request Form and open it in your preferred online editor.

- Fill in your customer information at the top of the form, including your name, Fidelity account number, and daytime phone number.

- Select the reason for your withdrawal by checking the appropriate box. Ensure you choose the correct reason to prevent any reporting issues.

- In the IRA withdrawal instructions section, choose either Option A, B, or C based on the type of IRA you have and your desired withdrawal method.

- Complete the tax withholding election by indicating whether you want federal or state taxes withheld from the distribution.

- Select your preferred method of payment by indicating whether you want the funds transferred to your Fidelity account, sent by check, or wired to your bank.

- Read the authorization and signature section carefully. Ensure you understand the implications and sign the form where indicated. Include a signature guarantee if required.

- Save your changes. Once completed, you can download, print, or share the form according to your needs.

Complete your Ira Single Withdrawal Request Form online today for a hassle-free withdrawal process.

You will receive a Form 1099-R when you make a withdrawal from a IRA, 401(k) or other retirement account. This form includes information such as: the amount you withdrew, how much is taxable (if that was determined), any taxes that were withheld, and a code that shows what type of distribution it was.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.